According to an international report launched by the World Economic Forum – in partnership with the Singapore Economic Development Board (EDB) – the top five most digitally mature sectors in 2022 are Semiconductors, Electronics, Pharmaceuticals, Energy & Chemicals and Logistics. You can find the full report here.

The top four most mature industry groups in 2022 are the same from 2019: Semiconductors, Electronics, Pharmaceuticals and Energy & Chemicals. The middle two traded between the second and third spots from the previous rankings published in November 2019. In spite of their frontrunning positions, the top three industries – predominantly comprising multinational conglomerates – are not shielded from present-day challenges like the ongoing value-chain disruptions, global chip shortage and industrial decarbonization.

The Logistics industry group has improved over the past three years to take fifth place. Operations in logistics have changed dramatically as a result of two key considerations. First off, the sector has been motivated to modernize and optimize its operations in order to meet growing demands as a result of the unrivaled rise of online shopping. Second, the rise of e-commerce titans like Amazon, Alibaba, and JD.com has forced conventional logistics firms to become more responsive, adaptable, and effective. In the upcoming years, it is anticipated that the logistics sector’s digital transformation will pick up speed as COVID-19 continues to fuel online purchasing on a worldwide scale.

On the other hand, industries with high volatility demand unique strategies. For instance, after two decades of consolidation, the electronics industry is now dominated by industrial behemoths like Sony, Samsung, Intel, Haier, and Huawei. While the facilities of big multinational conglomerates are frequently extensively digitalized, many established businesses in the sector have lagged behind. Interventions would need to change in light of the variations. MNCs, for instance, might collaborate with data analytics partners to enhance operations at their highly sophisticated manufacturing facilities, while legacy businesses might think about collaborating with system integrators to create modular, turnkey Internet of Things (IoT) solutions for their equipment and systems.

Best-in-Class companies have focused significantly on connectivity to enable greater integration and insights generation

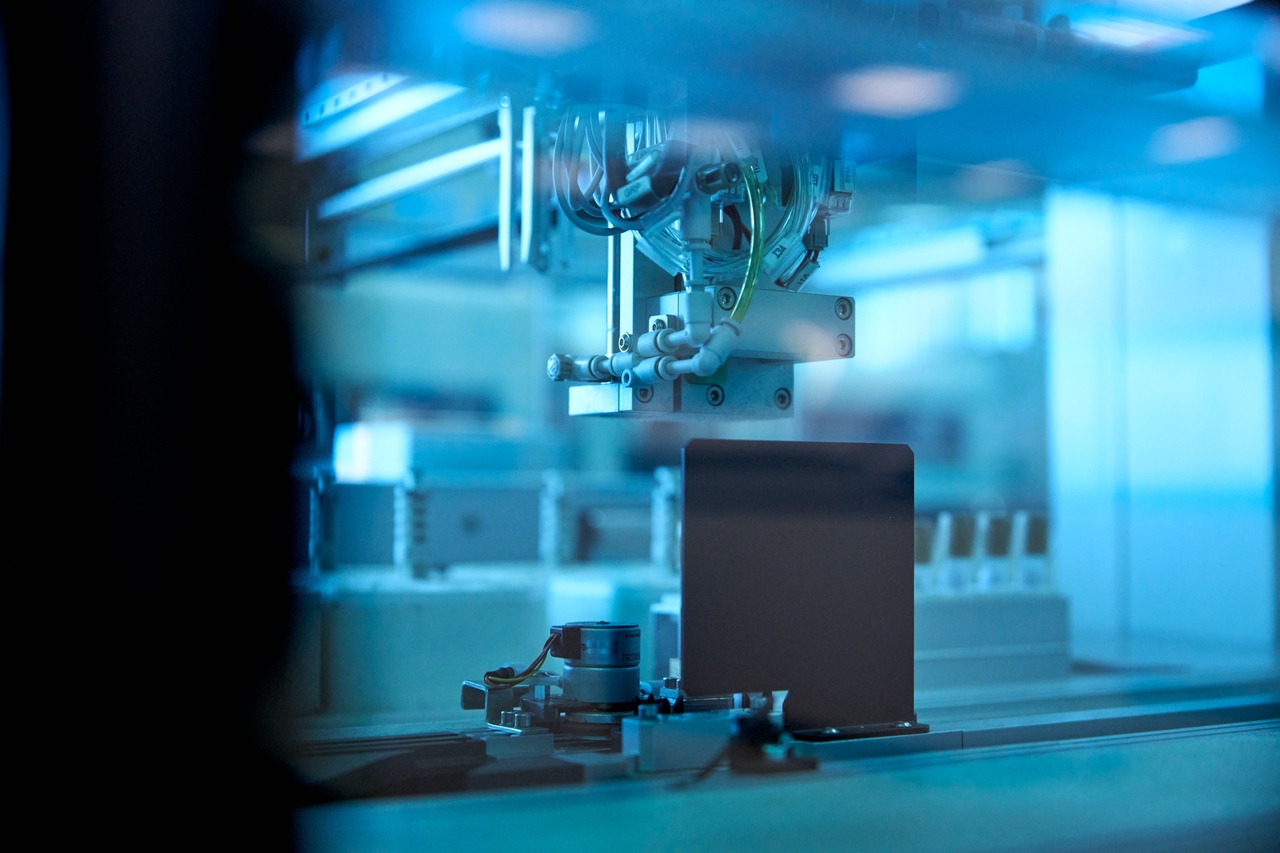

In the Third Industrial Revolution, automation was regarded as the central engine for industry transformation. But in today’s digital economy, the phrase “data is the new oil” holds true and connectivity is fast joining automation as another key driver of success. A highly connected factory, where all assets (products, materials, and labor) are connected via a common network, benefits a business in two key ways: it allows for more extensive and efficient machine-to-machine and human-to-machine communications, and it helps businesses better utilize data to produce new insights and support more real-time decision-making. Today’s best-in-class businesses recognize the value of connectivity. Many companies already have interoperable and secure networks in place inside their manufacturing facilities, allowing for relatively unrestricted communication and interaction between computers, machinery, and other equipment. To cut down on the delay in acquiring fresh data and insights, several companies are now actively involved in making these exchanges in real time.

Manufacturers should put more emphasis on refreshing and broadening their strategies for digitalization and workforce retraining

To facilitate their transformation and provide them a competitive edge, businesses must adjust both their organizational structures and worker competencies in addition to improving their processes and technology. “No economy can succeed without a high-quality workforce, particularly in an age of globalization and technological development,” remarked American economist Ben Bernanke. In manufacturing, this is valid. Surprisingly, though, the typical manufacturer still relies on really fundamental learning and development (L&D) programs. Such programs often have a distinct beginning and end, and their only goal is to give participants the skills they need to execute a job in accordance with the standards of the day.

However, job scopes and work arrangements are quickly changing as a result of digitalization, IT/OT convergence, and enhanced automation. As remote working becomes more common in the digital era, manufacturers may need to reconsider how they structure their workforce and workspaces in addition to evaluating L&D programs to include broader or continuous learning components.

The report “The Global Smart Industry Readiness Index Initiative: Manufacturing Transformation Insights Report” offers new insights and findings emerging from the Industry. The initiative aimed to build the world’s largest data sets and benchmarks on the current state of manufacturing globally by accelerating the adoption of SIRI (Smart Industry Readiness Index) as the international standard for Industry 4.0 benchmarking and transformation.