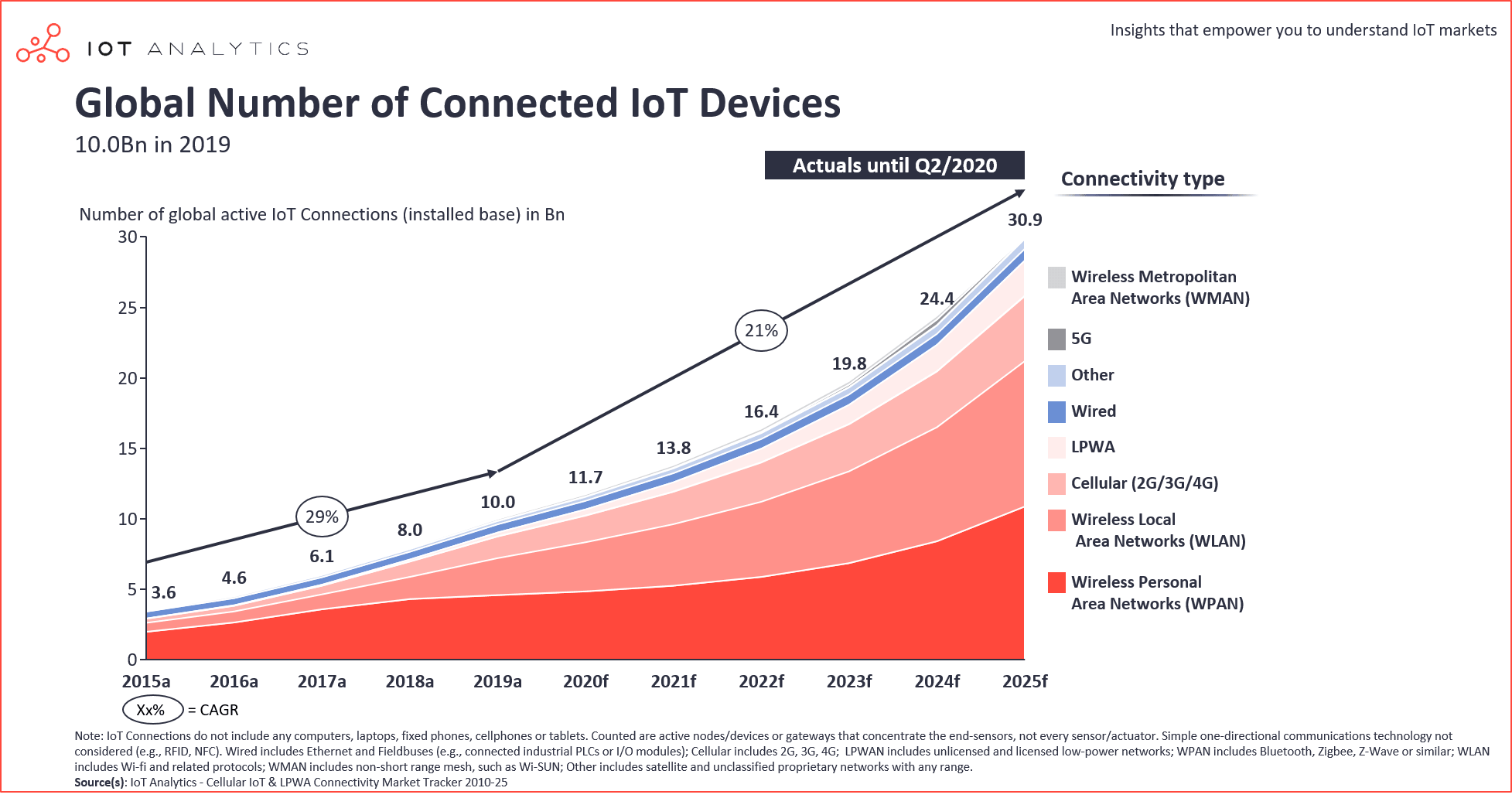

Despite the ongoing Covid-19 pandemic, the market for the Internet of Things continues to grow. In 2020, for the first time, there are more IoT connections (e.g., connected cars, smart home devices, connected industrial equipment) than there are non-IoT connections (smartphones, laptops, and computers). Of the 21.7 billion active connected devices worldwide, 11.7 billion (or 54%) will be IoT device connections at the end of 2020. By 2025, it is expected that there will be more than 30 billion IoT connections, almost 4 IoT devices per person on average.

This is one of many findings in IoT Analytics’ latest reports State of the IoT Q4 2020 & 2021 outlook as well as the updated Cellular IoT connectivity & LPWA Market Tracker 2010-2025 (Q4/2020 update).

Compared to an analysis performed in mid-2018, IoT Analytics has now raised its forecast for the number of connected IoT devices in 2025 (from 21.5 billion to 30.9 billion). Several factors are driving the growth, most notably:

- China. IoT has been booming in China at levels that seemed unimaginable a few years ago. While in 2015, for example, Chinese telecom companies accounted for roughly one quarter (27%) of all cellular IoT connections, this number has shot up to 75% in 2020 with China Telecom, China Unicom, and China Mobile leading the global cellular IoT connections market.

- Personal and home devices. The pervasive use of personal IoT devices such as fitness wearables further accelerated in the last 2 years and is expected to continue to do so. The introduction and subsequent adoption of a new generation of ecosystem-enabled smart home devices such as the Amazon Echo led to faster adoption of connected home devices than previously assumed.

- LPWA. Counting a mere 10 million connections in 2015, the global market for low-power wide-area (LPWA) connectivity was quasi non-existent 5 years ago. LPWA enables IoT connections for remote battery-powered devices such as smart meters, containers in logistics, or critical infrastructure like fire hydrants in cities. In 2020 this market reached 423 million IoT connections and is expected to grow at a CAGR of 43% to reach 2.5 billion IoT connections by 2025.

Going forward, IoT devices are expected to continue to grow much faster than the quasi-saturated market of non-IoT devices. The current forecast is that there will be 30.9 billion connected IoT devices by 2025 further driven by new technology standards like 5G.

The Cellular IoT & LPWA market

Both cellular IoT (2G, 3G, 4G, and now also 5G) as well as LPWA (NB-IoT, LTE-M, Lora, Sigfox, and others) have been key drivers of the global IoT connectivity market in the past 5 years. The number of active cellular IoT and LPWA connections grew at an annual rate of 43% between 2010 and 2019 and is expected to grow at a rate of 27% going forward, according to IoT Analytics’ new Cellular IoT & LPWA connectivity market tracker.

Cellular IoT

As discussed earlier in this article, China has moved to the forefront of cellular IoT connections. China Mobile, China Telecom, and China Unicom account for almost three-quarters of the market. In the past 12 months, China Mobile increased its market share by more than 5 percentage points. US-based AT&T lost one percentage point and now sits at 4% global market share in 2020. Apart from Vodafone, European-based providers do not make it in the top 5. The dominance of Chinese players can be largely attributed to the digital push by the Chinese government which views the adoption of cellular technologies (particularly 5G and NB-IoT) as a competitive asset in the quest to move the equilibrium of technological innovation from the US and Europe towards China.

LPWA market

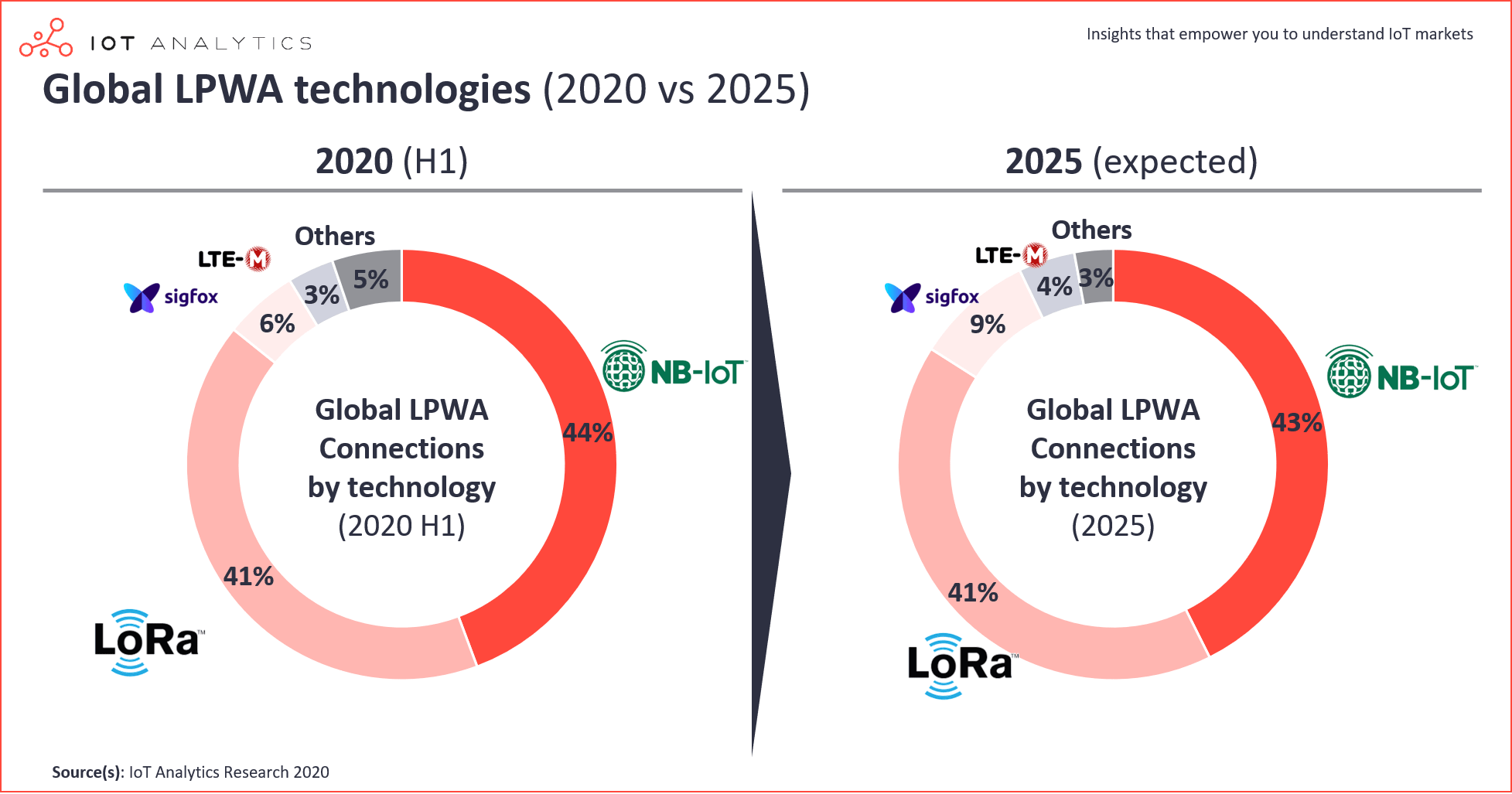

The rise of low-power wide-area networks is one of the biggest and perhaps the most unexpected connectivity technology success story of the 2010 decade. In 2010 almost nobody had heard of LPWA, even 5 years later the market was so nascent that there were only a few providers with a few million total connections. In 2020, LPWA is enjoying strong momentum. Some people believe that by 2030, the number of LPWA IoT connections could outnumber that of any other IoT connectivity technology.

The picture in 2020 is that of a two-horse race. LoRa (and LoraWAN) technology, which is operating in the unlicensed spectrum and largely driven by the Lora Alliance, is in a head-to-head battle with NB-IoT, which is operating in the licensed spectrum and mostly driven by leading telecommunication firms around the world.

IoT Analytics expects that those two technologies will continue to dominate the market in the coming 5 years, with Sigfox and LTE-M in distant third and fourth places, respectively. While other technologies continue to exist, at this point it does not appear as though they would play a significant role in the overall global market.